Every year I look forward to Small Business Week (this year it ran April 29th through May 5th). I’m the vice president of business development at SAFE Credit Union, so business is sort of my thing, and although it may seem odd to the average Joe or Jane, to me Small Business Week is an important and patriotic event.

Small Business Week is seven days of small business fun! Through a series of events and workshops, we celebrate and support the little (and midsized) engines that keep our economy growing. The week ultimately concludes with an exciting awards ceremony. SAFE has proudly nominated a number of our business members for awards and has seen several of them recognized by the Small Business Administration. Do I have my favorites? Yes! Still, in the end, we’re rooting for all the small businesses in our communities to prosper and succeed – but they need our help.

According to a 2016 report by the Small Business Administration, approximately 73 percent of small businesses used some form of financing in the previous 12 months.

According to a 2016 report by the Small Business Administration, approximately 73 percent of small businesses used some form of financing in the previous 12 months.

Recently, I attended a workshop hosted by the Small Business Development Center designed to give existing and future small business owners an opportunity to meet and question a variety of lenders that serve this market. Small businesses are critical to a healthy economy because they bring goods and services to our community and provide jobs that stabilize our employment base. Having an opportunity to meet and support new and growing small businesses in our region is one of the reasons SAFE enjoys participating and sponsoring these events. In addition, we can network with colleagues from other lending institutions and find out how the industry as a whole is serving local businesses.

While at one of this year’s workshops, I was fortunate to meet a gentleman who was gathering information to determine the best way to finance his new business concept. I don’t want to give the entire concept away (it may be the next million-dollar idea!), but generally speaking, it involved the convergence of tie-dye and beer (yes, you read that correctly). As I listened to his plan and looked at pictures of his product, I began to understand his vision and passion, and I wanted to support him by giving him a few easy tips to consider while building his business plan. These tips are a foundation that can benefit most early-stage entrepreneurs, and I am more than happy to share them here just in case one of you has a budding new business idea.

Four business financing tips for early-stage entrepreneurs:

- Do your research

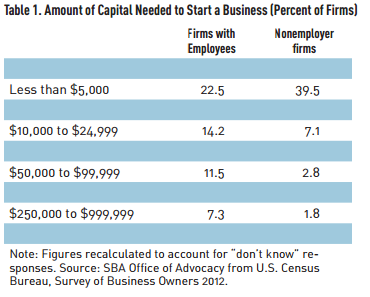

Spend the time necessary to research and understand the actual amount you will need to borrow. This means creating a list breaking down the use of the loan proceeds into as much detail as possible. Lenders tend to specialize by project type, industries, and collateral. By providing this information you will quickly align yourself with the lender that is the best match for your growing business. Also, if you have a written business plan (which is a good idea), try and put this information as close to the beginning as possible. Digging through 45 pages to ultimately determine your lending needs will not help either of us speed up the process. - Ask for referrals

If we are not able to assist you, please consider asking us for a referral to someone who may be able to assist you. Lenders tend to specialize in specific lending programs, collateral types or business sizes. We make it our business to survey the landscape of lenders much the same way a business owner understands their competitive landscape. As a result, we can often direct you to another institution or even a specific person at that institution that may be a better fit for your financing needs. - Be open to new ideas

Exchange ideas about how you want to expand your sales or enter new markets. Experienced business lenders may have observed best practices from others who have had success growing their businesses. We may also have some contact information for outside resources that can help with logistical hurdles. - Position as expansion vs. start-up

Whenever possible, express your project as an expansion rather than a start-up. If you've already started the business and have generated and tracked sales at any level, let the lender know you need funds to grow an existing business. We view any loan by its risk characteristics (collateral, cash flow, credit etc.). It's less risky to lend money to a business that has already experienced some level of sales and expense history than a business with no history at all. If you're seeking financing to move your existing business from your garage to a traditional retail setting, don’t tell us you want to start a new business when you already have one.

Over the past 20 years of working side-by-side with business lenders, it has become more clear to me that many of us are in the business because we admire and even envy small business owners. Successful business owners have an unrelenting drive and passion for what they do. Sometimes, I even like to imagine that million dollar moment - a late night idea that may have been scribbled down on a cocktail napkin, or maybe a near-miss encounter with an angry badger that led to a new anti-badger invention – well, you get the idea. Lenders like me tend to have more risk-averse personalities, so our envy comes from the admiration we have for business owners who take the risk to follow their dreams.

Small Business Week gives us an opportunity to shine a spotlight on the local entrepreneurial spirit. I applaud and thank the local small businesses for all that they do for our community, and I encourage you to do the same. So the next time you see that entrepreneur behind the cash register on a holiday, standing in line at the post office to ship a package to a customer, or donating to the local Little League team, say thank you. Our communities are stronger because of them.