Here at SAFE Credit Union, 66% of our employees and a large percentage of our members are women. With such strong female representation, SAFE makes building financial freedom for women and for all our members a top priority. During Women’s History Month, we want to shine a light on the ways we work to ensure a bright future for women—especially in this changing economy.

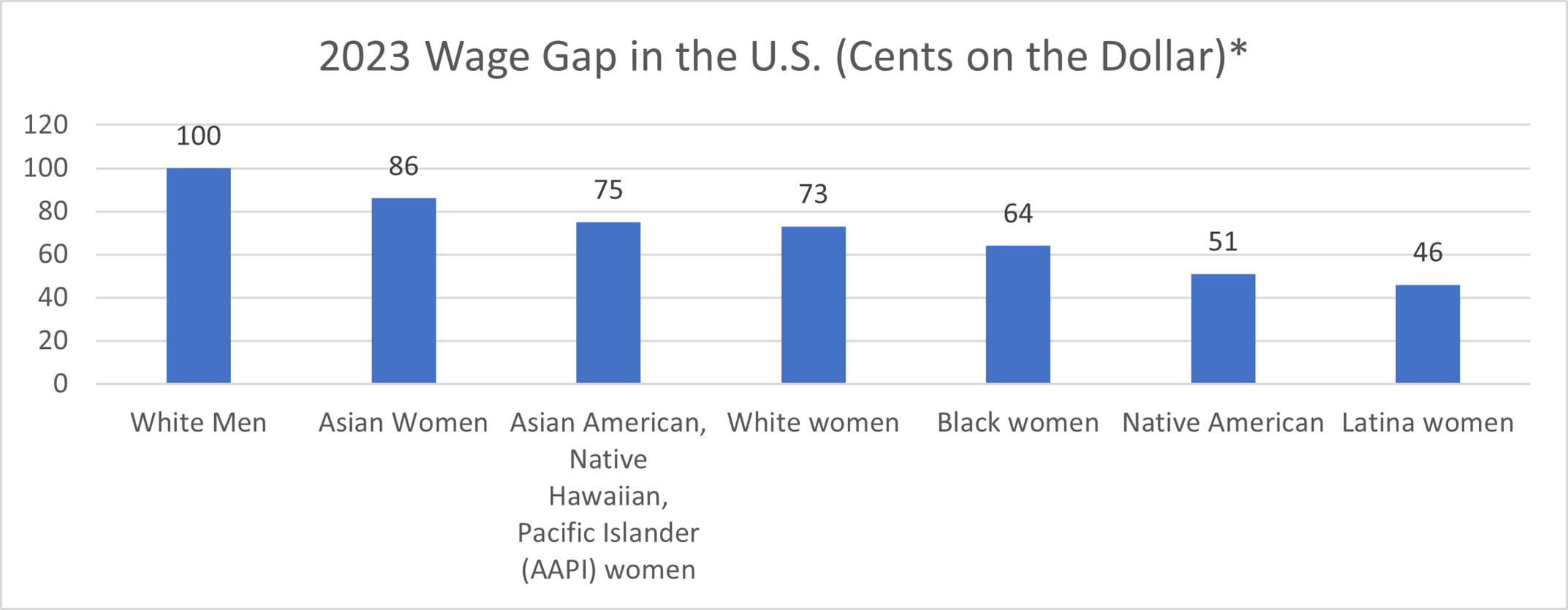

It may be 2023, but women in the U.S. still experience inequitable financial obstacles. Even though 55% of undergrad college students and 62% of enrolled graduate students are women, those degrees don’t translate into equal dollars in the workplace. Highly educated women still make cents on the dollar in comparison to their male counterparts, despite achieving equal to higher professional performance.

And in a time when inflation has us pinching pennies and busting budgets on simple purchases like coffee or eggs, it’s unsurprising that this disproportionately impacts women. Inflation has hit an all-time high at 6.4%, three times the Federal Reserve’s target of 2%. While we struggle to keep up, according to a recent Fortune article men’s salaries are 33% more likely to keep pace with inflation than women’s.

Despite these unsettling statistics, SAFE works hard to make sure that women members and employees alike feel empowered, heard, and represented. As an organization with over 247,000 members, SAFE prioritizes putting the best and brightest in leadership positions. Faye Nabhani made history this past January as SAFE’s very first woman CEO, and our team of powerful women in leadership was recently featured in an article in Comstock’s Magazine. These women each bring unique backgrounds, expertise, and perspectives to their high-level roles. You can check out Comstock’s March edition, Spotlight on Women Leaders from Around the Region to learn more about these change-makers and their impact at SAFE.

Amid today’s financial and economic uncertainty, we also want our members to better understand their finances and grow their wealth. Here is how SAFE strives to help women build financial independence:

Perfect Cents Podcast

Relationship Manager Alex Becerra and SAFE Community Impact Specialist Brit Kelleher host a bi-weekly podcast that features financial health insights relevant to today’s financial matters. Some of the most recent episodes feature influential women providing their expertise on important financial topics:

- Women’s History Month Featuring Faye Nahbani: Faye discusses making history as SAFE Credit Union’s first female CEO, her vision for the future at SAFE, and what being a woman in leadership means to her.

- Saving for the Unexpected: SAFE Contact Center Service Representative LaTroya Johnson discusses valuable insights on determining wants vs. needs, sticking to a budget, and taking advantage of free resources to help you save money for a rainy day.

- Saving at Any Age: SAFE Real Estate Processing Manager Sylvia Garcia covers the importance of starting your savings journey as early as possible and the impact different seasons of your life will have on what you’re saving for.

Check out these and other episodes featuring female financial experts on the Perfect Cents Podcast

SAFE and America Saves Week

This annual celebration encourages healthy money habits that promote becoming “a financially confident you.” This year, Financial Wellness Educators Savannah Brown and Miriam Dougherty championed SAFE’s financial wellness mission during America Saves Week. Check out their tips on becoming financially confident in our brand-new video series, on the Perfect Cents Podcast, and in our America Saves Week blog

Budgeting simulations

SAFE financial educators bring real-world financial insights to high school students and young adults through interactive workshops. These simulations provide young people with a first-hand look at the financial and budgeting decisions they will make as adults.

As students today face a possible economic downturn, immersive activities like these not only change the way students learn important financial skills, but also how they engage with them. With the wage gap and other monetary obstacles in mind, it’s invaluable for the thousands of female students entering the workplace and higher education after graduation to understand the importance of budgeting, saving, and making smart financial decisions at a young age.

Though financial freedom for all members remains crucial to our mission, SAFE prioritizes the financial success and empowerment of women. If you’re looking for more financial education resources this month, check out our list below and follow us on LinkedIn: